Annual Report Division of Enforcement

Wed 23 Jan, 2019 | Resources by Carl Schoeppl vCard

DISCLAIMER This is a report of the staff of the U.S. Securities and Exchange Commission. The Commission has expressed no view regarding the analysis, findings, or conclusions contained herein. Report available on the web at www.sec.gov/reports

CONTENTS

Message from the Co-Directors ………………………………………………………………………………………………1

Introduction …………………………………………………………………………………………………………………………..6

Initiatives ………………………………………………………………………………………………………………………………6

Focus on the Main Street Investor …………………………………………………………………………………..6

Policing Cyber-Related Misconduct…………………………………………………………………………………..7

The Share Class Selection Disclosure Initiative………………………………………………………………….8

Discussion and Analysis of Fiscal Year 2018………………………………………………………………………………9

Overall Results ………………………………………………………………………………………………9

Types of Cases ………………………………………………………………………………………………10

Distributions to Harmed Investors…………………………………………………………………………………….11

Disgorgement and Penalties Ordered……………………………………………………………………………….11

Individual Accountability…………………………………………………………………………………………………..12

Relief Obtained………………………………………………………………………………………………………………12

Litigation……………………………………………………………………………………………………………………….14

Allocation of Resources……………………………………………………………………………………………………………14

Noteworthy Enforcement Actions ……………………………………………………………………………………………..15

Appendix ……………………………………………………………………………………………………………………………….19 Endnotes………………………………………………………………………………………………………………………………..38

MESSAGE FROM THE CO-DIRECTORS Stephanie Avakian CO-DIRECTOR

Last year, the Division of Enforcement issued its first annual report discussing the enforcement-related accomplishments of the Commission. We continue that practice with this report, which presents and assesses the Division’s work during Fiscal Year (FY) 2018, highlights some of its more significant accomplishments, and discusses key initiatives. We believe that the Division’s work this year was a great success.

Last year, the Division of Enforcement issued its first annual report discussing the enforcement-related accomplishments of the Commission. We continue that practice with this report, which presents and assesses the Division’s work during Fiscal Year (FY) 2018, highlights some of its more significant accomplishments, and discusses key initiatives. We believe that the Division’s work this year was a great success.

But how do we measure success? As we have often emphasized, quantitative metrics—for example, the raw number of cases filed or the total amounts of fines and penalties assessed during an arbitrary time period such as a single fiscal year cannot adequately measure the effectiveness of an enforcement program. Indeed, we believe a singular focus on such metrics can result in a misalignment of incentives and objectives.

Instead, we believe the effectiveness of the program can better be measured by assessing the nature, quality, and effects of the Commission’s enforcement actions. Are we deterring future harm by bringing meaningful cases that send clear and important messages to market participants? Are we protecting investors and markets by holding individuals accountable for wrongdoing and removing bad actors from the securities markets? Are we stripping wrongdoers of their ill-gotten gains and returning money to victims? Are we acting quickly to stop frauds, prevent future losses, and return ill-gotten gains to harmed investors?

Instead, we believe the effectiveness of the program can better be measured by assessing the nature, quality, and effects of the Commission’s enforcement actions. Are we deterring future harm by bringing meaningful cases that send clear and important messages to market participants? Are we protecting investors and markets by holding individuals accountable for wrongdoing and removing bad actors from the securities markets? Are we stripping wrongdoers of their ill-gotten gains and returning money to victims? Are we acting quickly to stop frauds, prevent future losses, and return ill-gotten gains to harmed investors?

To be sure, these measuring sticks are more difficult to employ than counting up the raw number of cases or offering a gross total of financial sanctions. But those raw numbers and gross totals do little to provide a true picture of whether the Division’s efforts have furthered the Commission’s three-part mission of protecting investors, maintaining fair, orderly, and efficient markets, and facilitating capital formation. To effectively assess our performance, and guide our future efforts, we must be more rigorous and thoughtful in our analysis.

In our report last year, we articulated five principles that would guide the Division’s assessment of its performance: (1) focus on the Main Street investor; (2) focus on individual accountability; (3) keep pace with technological change; (4) impose remedies that most effectively further enforcement goals; and (5) constantly assess the allocation of our resources. We believe the efforts of the Division’s dedicated leadership and staff—at headquarters in Washington, DC, and across the country in our 11 regional offices—over the past fiscal year reflect a faithful adherence to these principles.

Principle 1: Focus on the Main Street Investor

The Division of Enforcement is focused on protecting the interests of the Main Street, or retail, investor. These are market participants who need and deserve the attention of the Commission. Over the past fiscal year, the Division investigated and recommended to the Commission hundreds of cases alleging misconduct perpetrated against retail investors. Many of those cases were simultaneously resolved, resulting in meaningful and prompt relief. The balance is being pursued through litigation. Our focus on identifying and addressing misconduct against Main Street investors has also resulted in a pipeline of hundreds of retail-focused investigations that were ongoing at the close of the fiscal year. Importantly, Division personnel again worked diligently to return substantial sums to harmed investors—this year $794 million.

The Division’s focus on protecting Main Street investors was also reflected in two important initiatives over the past fiscal year. First, the Retail Strategy Task Force, formed in FY 2018, contributed to the Division’s retail focus by leveraging enforcement resources and drawing on expertise from across the Commission to develop and implement strategies and techniques for addressing the types of misconduct that most affect retail investors. And, second, during FY 2018, the Commission announced the Share Class Selection Disclosure (SCSD) Initiative, a program designed to quickly and efficiently bring relief to investors who may have been harmed by failures to disclose conflicts of interest related to marketing fees and expenses associated with the selection of mutual fund share classes. Scores of investment advisers participated in the SCSD Initiative, which will result in charges against them. We expect investors to benefit greatly from the money that will be repaid to them by participants in the initiative. Importantly, the goal of this initiative is to ensure that advisers and their affiliates properly disclose their conflicts of interest.

As we said before, we do not believe the Commission faces a binary choice between protecting Main Street and policing Wall Street. It must do both. In many cases, including those highlighted by our SCSD Initiative, misconduct at these institutions causes substantial harm to investors on Main Street. This year, as the Division of Enforcement, focused its lens on protecting Main Street investors, it continued to investigate and recommend actions against financial institutions, intermediaries, and other market participants.

Principle 2: Focus on Individual Accountability

Holding individuals accountable for wrongdoing is a key pillar of any strong enforcement program. Institutions act only through their employees, and holding culpable individuals responsible for wrongdoing is essential to achieving our goals of general and specific deterrence and protecting investors by removing bad actors from our markets. The SEC’s actions over the past year illustrate the premium we place on establishing individual liability where appropriate. In FY 2018, the Commission charged individuals in more than 70% of the stand-alone enforcement actions it brought. Those charged include individuals at the top of the corporate hierarchy, including numerous CEOs and CFOs, as well as accountants, auditors, and other gatekeepers.

Principle 3: Keep Pace with Technological Change

Technology continues to transform not only our markets but also the ability of wrongdoers to engage in cyber-related and other misconduct. The Division of Enforcement has continued to work to keep pace with these important changes.

Notably, in FY 2018, the Division’s Cyber Unit became fully operational and—together with staff across the Division—spearheaded investigations which led to significant enforcement actions in the cyber area. For example, the SEC brought an action against the entity formerly known as Yahoo! Inc., which was the agency’s first case against a public company for failing to properly inform investors about a cyber breach. The SEC also brought its first action against a firm for violations of the Identity Theft Red Flags Rule, as well as additional cases involving false regulatory filings allegedly made for the purpose manipulating the price of securities.

Led by the Cyber Unit, the Division emerged as a global leader in addressing misconduct relating to digital assets and initial coin offerings (ICOs). We believe our approach to enforcement in this space has been thoughtful and consistent. Importantly, it has provided a template for authorities in other countries, where fraud and misconduct targeting U.S. investors often have been based.

Given the explosion of ICOs over the last year, we have tried to pursue cases that deliver broad messages and have a market impact beyond their own four corners. To that end, we have used various tools—some traditional, such as the Commission’s trading suspension authority, and some more novel, such as the issuance of public statements—to educate investors and market participants, including lawyers, accountants, and other gatekeepers. We believe these investor-protection efforts have been successful.

We also have recommended enforcement actions for conduct ranging from registration violations to unregistered broker-dealer activity to instances in which the purported use of blockchain-related technology is merely a veneer for outright fraud. A poignant example of our impactful approach is the SEC’s enforcement action against the co-founders of a purported fnancial services start-up. This action, coupled with the Enforcement Division’s joint statement with the Commission’s Office of Compliance Inspections and Examinations urging caution around celebrity promotion of ICOs, brought an almost immediate end to such promotions. Another example is the SEC’s action against an allegedly fraudulent ICO that targeted retail investors to fund what it claimed to be the world’s first “decentralized bank.” We moved quickly to stop the fraud by obtaining a court order, and the action showcased our ability to obtain a receiver over digital assets.

Finally, the Division has continued to leverage its own technology to accomplish its enforcement goals. Using proprietary tools to conduct sophisticated data analysis, the Division has identified and pursued a wide variety of misconduct, including insider trading, “cherry-picking” schemes, and the sale of unsuitable investment products or programs to retail investors.

Principle 4: Impose Remedies That Most Effectively Further Enforcement Goals

In each case we bring to the Commission, we seek to recommend a package of remedies and relief that best addresses the underlying misconduct. In most cases, that will include financial remedies—i.e., disgorgement, penalties, or both—and bars and suspensions, which help to preserve the integrity of our markets and protect investors. Such relief is essential to ensure appropriate punishment, deprive wrongdoers of their ill-gotten gains, deter would-be wrongdoers from violating the federal securities laws, and return funds to harmed investors.

Yet we have increasingly looked to the wide range of other tools at our disposal and aimed, whenever possible, to supplement financial remedies by tailoring specific relief that best addresses the underlying charged conduct. Two examples from the last fiscal year include the Commission’s settlement with the CEO of Theranos, and the settlement with Tesla and its Chairman and CEO, both of which paired significant monetary relief with investor-oriented undertakings tailored to both remediate the harm visited on shareholders by the misconduct at issue and provide shareholders with greater protection in the future.

In the case of Theranos, the Commission alleged that the CEO had misused her near total control of the company to defraud investors. The Commission’s settlement stripped the CEO of her super-majority voting control and ensured that she would not benefit from any future sale or other liquidation events until other shareholders had first been made whole. In the case of Tesla, the Commission alleged that the Chairman and CEO had engaged in fraud through a series of false and misleading tweets about a purported take-private transaction. The remedies included not only significant penalties, but also substantially enhanced corporate governance—including requiring the appointment of two new independent directors, a new committee of independent directors, and the CEO to step down as the company’s Chairman—as well as oversight of the CEO’s communication practices.

Principle 5: Constantly Assess the Allocation of Our Resources

Effective management and ensuring the appropriate allocation of resources go hand-in-hand. Because we have limited staff (our total headcount is down approximately 10% from its peak in FY 2016), and our responsibilities continue to expand with our ever-evolving market, we must always assess the allocation of our resources.

The results from the past year are derived both from the Division’s dedicated staff rising to the challenge and from an effective allocation of resources. We shifted resources into market segments presenting emerging risks, including cyber threats and ICOs. We implemented innovative initiatives, such as the SCSD Initiative, which we expect to result in the return of substantial funds to retail investors. And we have paid careful attention to case selection, attempting to open and pursue investigations that are likely to have the most meaningful impact for investors and the markets.

Evaluating Our Efforts

Judged on a qualitative basis—including against the guiding principles discussed above—we believe the Division of Enforcement achieved many notable successes in FY 2018—recommending that the Commission bring significant actions against important market participants, achieving successes for retail investors, fashioning meaningful and effective remedies and relief, and addressing emerging and developing risks.

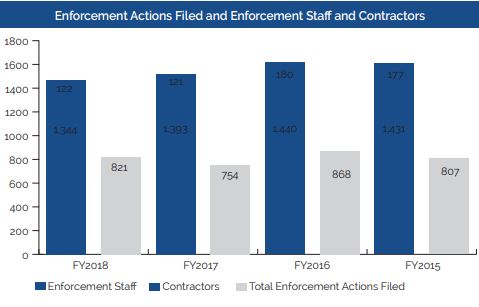

Above we discussed the limitations of raw quantitative metrics. Notwithstanding the limitations associated with such metrics, FY 2018 reflected a high level of activity by the Division of Enforcement. The Commission brought 821 actions (490 of which were “stand-alone” actions) and obtained judgments and orders totaling more than $3.9 billion in disgorgement and penalties. Significantly, it also returned $794 million to harmed investors, suspended trading in the securities of 280 companies, and obtained nearly 550 bars and suspensions. By these raw metrics, our overall results improved compared to FY 2017.

These results were achieved despite significant challenges. For one, our personal resources are down. Due to budgetary constraints, we have lost many of our contracted legal support personnel and we have been subject to an agency-wide hiring freeze, limiting our ability to replace employees who have departed. In addition, we have faced a number of challenging legal decisions. The Supreme Court’s decision in Kokesh v. SEC has limited our ability to obtain disgorgement in certain long-running frauds. With respect to matters that have already been fled, we estimate the decision may cause us to forego up to approximately $900 million in disgorgement, of which a substantial amount likely could have been returned to retail investors. And a successful constitutional challenge to the appointment of the Commission’s administrative law judges in the Lucia v. SEC Supreme Court case has required the Division to divert substantial trial and other resources to older matters, many of which had been substantially resolved prior to the decision.

The totality and effectiveness of our efforts in the face of these challenges is a testament to the dedication of the women and men of the Division of Enforcement. As a result of their efforts, during the past fiscal year, the Division of Enforcement has been successful in its mission. We look forward to continued success in FY 2019 and beyond.

Sincerely,

Stephanie Avakian and Steven Peikin

Co-Directors, Division of Enforcement

U.S. Securities and Exchange Commission

November 2, 2018

Introduction

The Division of Enforcement is responsible for civil enforcement of the federal securities laws. Each year, the SEC brings hundreds of actions against individuals and entities and secures remedies that protect investors by punishing misconduct, deterring wrongdoing, removing bad actors from our markets, and, where possible, compensating harmed investors. These efforts are a critical component of the SEC’s mission to protect investors and maintain confidence in the fairness and integrity of U.S. markets.

The Division’s work is guided by five core principles: (1) focus on the Main Street investor; (2) focus on individual accountability; (3) keep pace with technological change; (4) impose remedies that most effectively further enforcement goals; and (5) constantly assess the allocation of our resources. As detailed below, Enforcement staff’s focus on these key principles led to a number of noteworthy initiatives, cases, and other achievements in FY 2018, all of which were accomplished in the face of resource constraints and a challenging legal landscape for the Commission’s enforcement program.

Initiatives

The Division of Enforcement covers the broad ground. The SEC oversees approximately $90 trillion in annual securities trading, the disclosures of approximately 4,300 exchange-listed public companies valued at approximately $32 trillion, and the activities of over 27,000 registered entities and self-regulatory organizations. At the close of FY 2017, the Division took steps to focus additional resources on two key priority areas: protecting retail investors and combating cyber threats. The Division also announced an important new initiative designed to focus on misconduct that occurs in the interactions between investment professionals and their clients.

Focus on the Main Street Investor

During the past fiscal year, the Division continued to focus on protecting retail investors. Over half of the stand-alone enforcement actions brought by the SEC in FY 2018 involved wrongdoing against retail investors.

The Division’s Retail Strategy Task Force (RSTF), which was formed in FY 2018, has made significant contributions to the Division’s retail focus. During FY 2018, the RSTF undertook a number of lead-generation initiatives built on the use of data analytics. All of the RSTF lead-generation initiatives involve collaboration with data analytics groups located throughout the Commission, including the Division of Economic and Risk Analysis (DERA) and the Office of Compliance Inspections and Examinations (OCIE). These initiatives involve several important issues impacting retail investors, including disclosures concerning fees and expenses and conflicts of interest for managed accounts; market manipulations; and fraud involving unregistered offerings.

Additionally, in partnership with the Division’s Cyber Unit and Microcap Fraud Task Force, as well as the Division of Corporation Finance’s Digital Asset Working Group, the RSTF has launched a lead-generation and referral initiative involving trading suspensions related to companies that purport to be in the cryptocurrency and distributed ledger technology space.

Policing Cyber-Related Misconduct

Since the formation of the Cyber Unit at the end of FY 2017, the Division’s focus on cyber-related misconduct has steadily increased. In FY 2018, the Commission brought 20 stand-alone cases, including those cases involving ICOs and digital assets. At the end of the fiscal year, the Division had more than 225 cyber-related investigations ongoing. Thanks to the work of the Unit and other staff focusing on these issues, in FY 2018 the SEC’s enforcement efforts impacted a number of areas where the federal securities laws intersect with cyber issues.

The SEC was active in policing cyber-related misconduct in FY 2018. For instance, at the end of FY 2018, the SEC brought settled proceedings against an Iowa-based broker-dealer and investment adviser related to its failures in cybersecurity policies and procedures surrounding a cyber intrusion that compromised the personal information of thousands of its customers, in violation of Regulations S-P and S-ID. This was the SEC’s first action charging violations of Regulation S-ID, known as the Identity Theft Red Flags Rule, which is designed to protect customers from the risk of identity theft.1 The SEC also brought charges against a second defendant in connection with a scheme to allegedly manipulate the price of Fitbit securities through false regulatory filings.2 And, the SEC charged a day trader with allegedly participating in a scheme to access the brokerage accounts of more than 100 unwitting victims and make unauthorized trades to artificially inflate the stock prices of various companies.

ICOs and Digital Assets

The Division also remains focused on issues related to ICOs and digital assets. In just a few years, the prevalence of crypto-asset offerings, including ICOs, has exploded. But exuberance around these markets can sometimes obscure the fact that these offerings are often high-risk investments. For instance, the issuers may lack established track records, viable products, business models, or the capacity for safeguarding digital assets from theft by hackers. And some of the offerings are simply outright frauds cloaked in the veneer of emerging technology.

The Enforcement Division recognizes the need to balance its mission to protect investors from the risk posed by fraud and registration violations against the risk of stifling innovation and legitimate capital formation.4 Generally, the Division’s approach to ICOs and digital assets has taken the following forms:

•The Division has used public statements to send messages to the ICO and digital asset marketplace on issues such as the potentially unlawful promotion of ICOs by celebrities and others,5 and the risks associated with online trading platforms for digital assets.

•When warranted, the Division has recommended enforcement actions to the Commission in matters involving ICOs. As of the close of FY 2018, the SEC had brought over a dozen stand-alone enforcement actions involving digital assets and ICOs.7 While many of these cases have involved allegations of fraud, the Division also has pursued enforcement actions to ensure compliance with the registration requirements of the federal securities laws. In the past year, the Division has opened dozens of investigations involving ICOs and digital assets, many of which were ongoing at the close of FY 2018.

•The Division’s focus also extends beyond the issuers of ICOs. In FY 2018, the Commission announced a settled order against two individuals who ran a self-described “ICO Superstore” that operated as an unregistered broker-dealer and participated in unregistered offerings.9 On the same day, the Commission filed a settled action against a hedge fund manager that violated an investment company registration provision based on its investments in digital assets.

•The Division also has recommended that the Commission use its trading suspension authority to prevent investors from being harmed by possible scams. In both FY 2017 and FY 2018, the Commission suspended trading in the stock of over a dozen publicly traded issuers because of questions concerning, among other things, the accuracy of assertions regarding their investments in ICOs and operation of cryptocurrency platforms.

Public Company Disclosures of Cybersecurity Risks and Incidents

The accuracy of cyber-related disclosures is a significant priority for the Commission, as evidenced by the Commission’s approval in FY 2018 of a statement and interpretive guidance to assist public companies in preparing disclosures about cybersecurity risks and incidents.12 In FY 2018, the Commission also brought its first enforcement action involving charges against a public company for failing to properly inform investors about what was then the largest known cyber-intrusion in history. The SEC’s order found that Yahoo! failed to properly assess the scope, business impact, or legal implications of the breach, including whether, when, and how the breach should have been disclosed. To settle the action, the entity formerly known as Yahoo! agreed to pay a $35 million penalty.

The Share Class Selection Disclosure Initiative

The Division of Enforcement also focused on misconduct that occurs in the interactions between investment professionals and retail investors. One aspect of these interactions involved disclosure failures relating to marketing and distribution fees paid by advisory clients, often referred to as “12b-1 fees.” These fees are typical for certain share classes offered throughout the mutual fund industry, and advisers are required to accurately disclose their practice of selecting a more expensive mutual fund share class when a lower-cost share class for the same fund is available.

The Commission has brought more than 15 enforcement matters involving share class disclosures in just the last five years and OCIE has continued to make such disclosures a priority in its exams and public statements.14 Despite these efforts, disclosure failures persist. Indeed, at the time the Initiative was announced, the Division had close to a dozen ongoing investigations—which, on average, take nearly two years to complete—relating to these practices.

In an attempt to address this continuing problem, the Division launched the Share Class Selection Disclosure Initiative in FY 2018. The Initiative is a voluntary program for investment advisers to self-report to the Commission their failures to disclose their financial conflicts of interest relating to the compensation they received in the form of 12b-1 fees.15 The Initiative has two goals: (1) ensuring that these conflicts are adequately disclosed to investors; and (2) getting money back into the pockets of investors as quickly and efficiently as possible.

For those who self-reported by the deadline and satisfy the requirements of the Initiative, the Enforcement Division will recommend to the Commission settlements with standardized terms that include antifraud charges and an agreement to pay disgorgement to harmed investors. In an effort to incentivize participation in the Initiative, the Enforcement Division stated that it would recommend that the Commission not impose a penalty against those participating in the Initiative. We believe that by pursuing this Initiative, we will identify, address, and remediate many more violations—and will do so much more quickly—than if we had continued to pursue these violations on a case-by-case basis.

Discussion and analysis of FY 2018

Overall Results

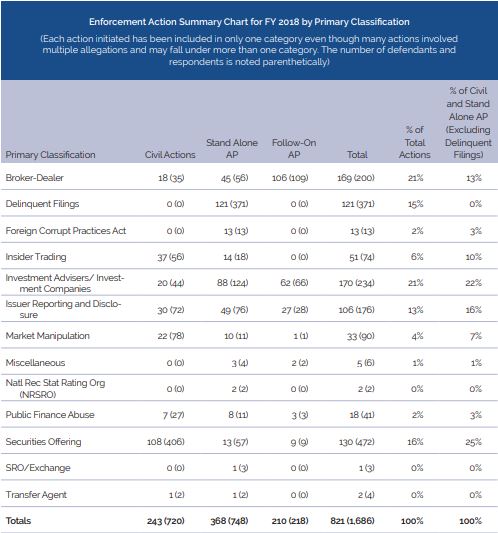

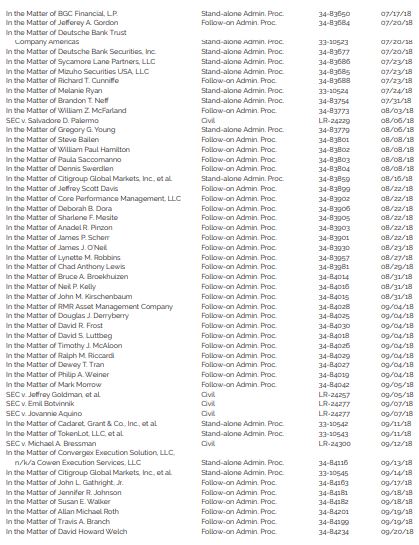

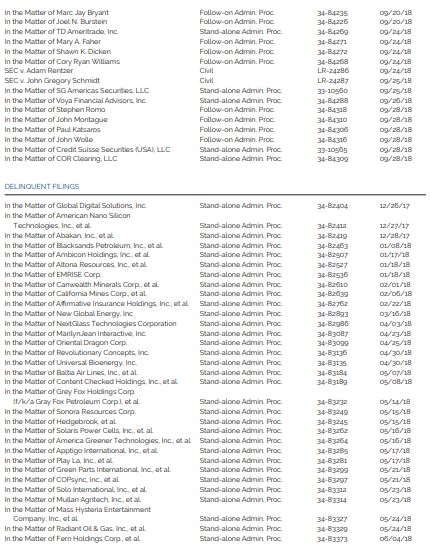

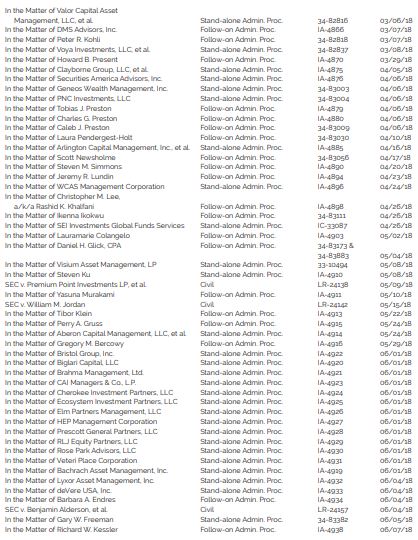

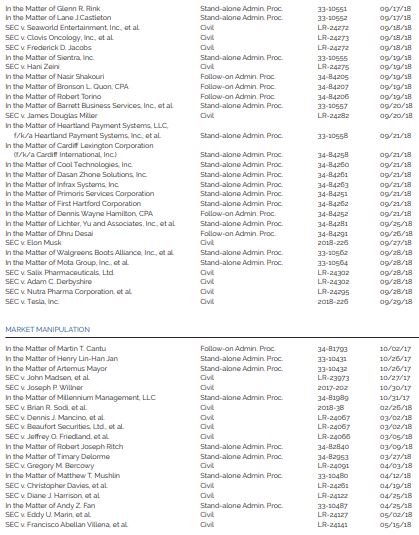

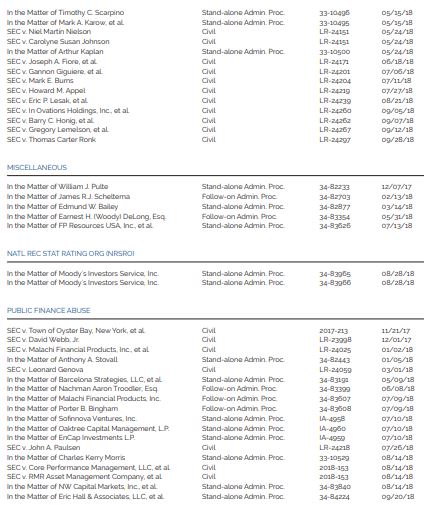

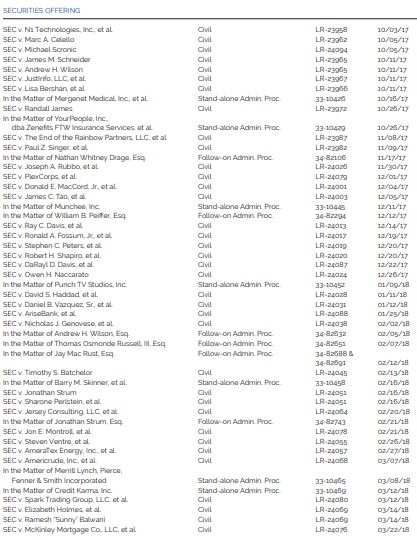

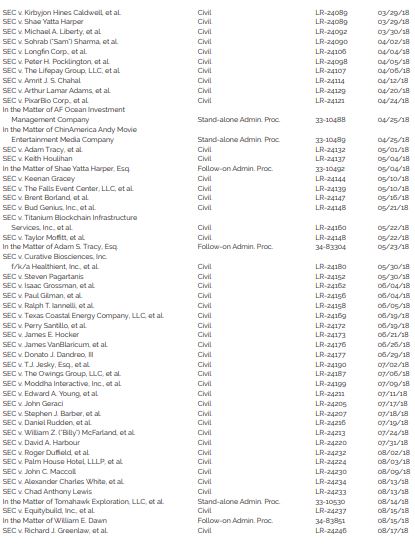

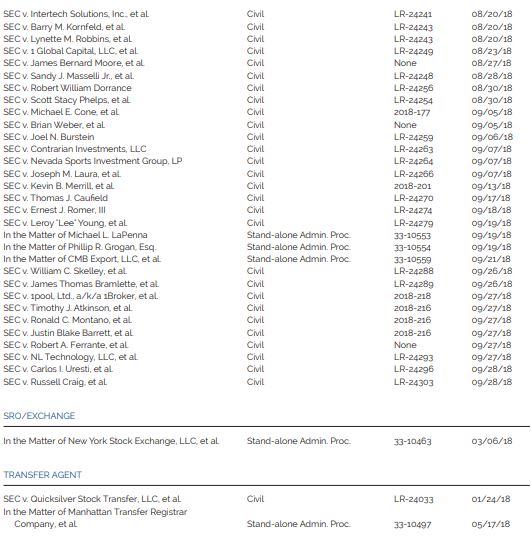

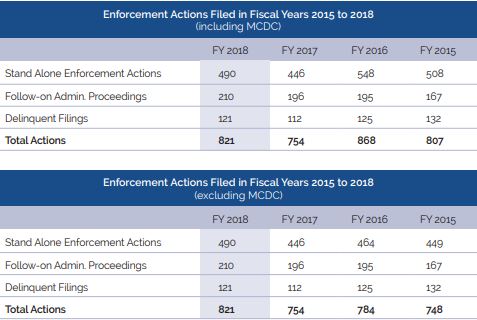

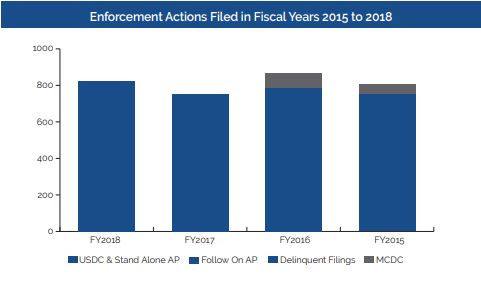

In FY 2018, the Commission brought a diverse mix of 821 enforcement actions, of which:

•490 were “stand-alone” actions brought in federal court or as administrative proceedings;

•210 were “follow-on” proceedings seeking bars based on the outcome of Commission actions or actions by criminal authorities or other regulators; and

•121 were proceedings to deregister public companies—typically microcap issuers—that were delinquent in their Commission filings.

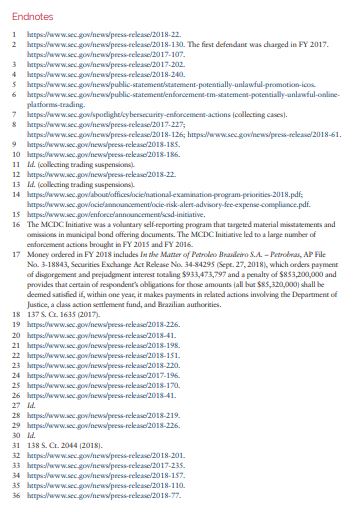

As we noted in last year’s report, cases brought in connection with certain initiatives—such as the Commission’s Municipalities Continuing Disclosure Cooperation (MCDC) Initiative,16 which ran from FY 2015 to FY 2016—can skew the results for a particular year. Accordingly, the tables below present the results over the past four fiscal years, both with and without the stand-alone actions attributable to the MCDC Initiative:

As the below chart refects, the number of stand-alone enforcement actions brought in FY 2018 increased from the prior year.

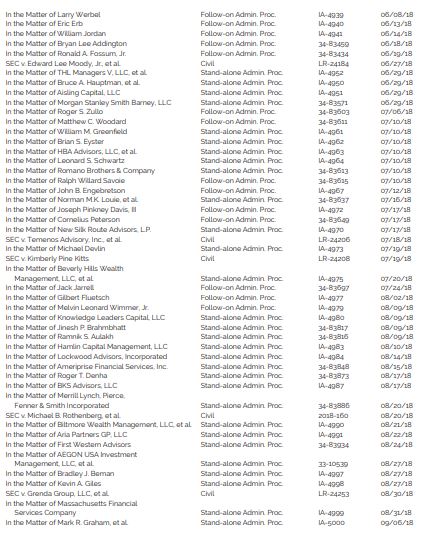

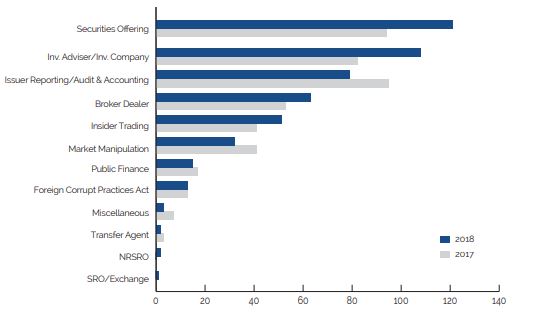

Types of Cases

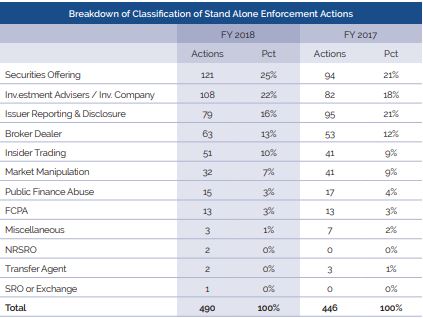

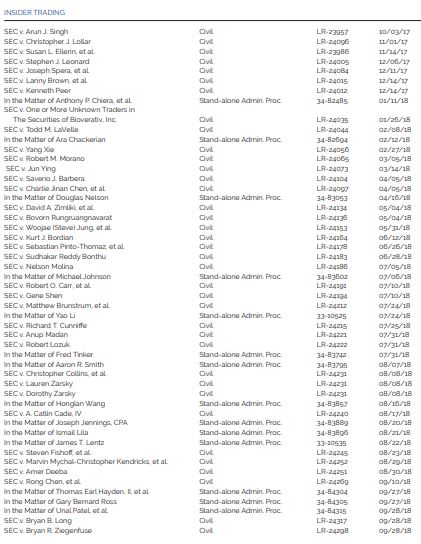

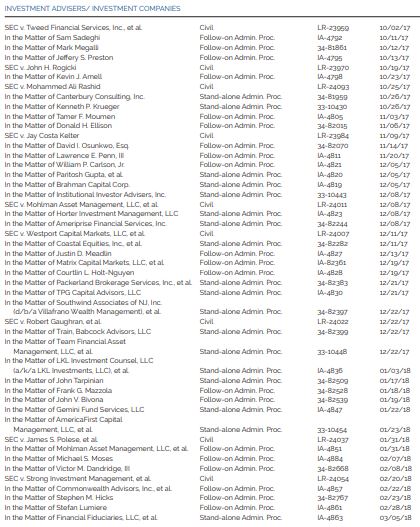

As the below chart illustrates, a significant number of the Commission’s 490 stands alone cases in FY 2018 concerned securities offerings (approximately 25%), investment advisory issues (approximately 22%), and issuer reporting/accounting and auditing (approximately 16%). The Commission also continued to bring actions relating to broker-dealer misconduct (13%), insider trading (10%), and market manipulation (7%).

A breakdown of the number and percentage of the types of actions brought in FY 2018 and FY 2017 is in the attached appendix.

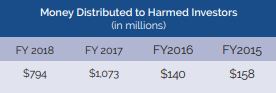

Distributions to Harmed Investors

The Commission places a significant priority on returning funds to harmed investors whenever possible. Consistent with that goal, a substantial amount of money was returned to harmed investors again in FY 2018.

A significant portion of the total funds distributed in FY 2018 ($474 million) came from one Fair Fund—a distribution from the BP p.l.c. fund. The balance of the funds distributed in FY 2018 ($320 million) came from 46 other distribution funds comprised of 25 Fair Funds ($171 million) and 21 Disgorgement Funds ($149 million).

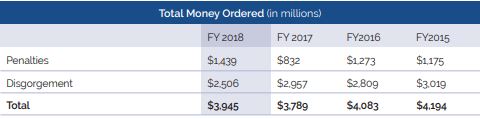

Disgorgement and Penalties Ordered

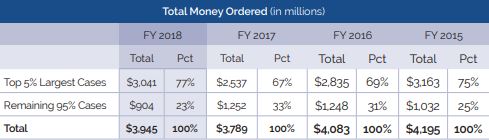

In FY 2018, the Commission continued to obtain significant monetary judgments against parties in enforcement actions. All told, parties in the Commission’s actions and proceedings were ordered to pay a total of $2.506 billion in disgorgement of ill-gotten gains, a decrease over the prior year. Penalties imposed totaled $1.439 billion, an increase from the prior year. A significant amount of the money ordered in FY 2018 came from a single case.17 Total monetary relief ordered in FY 2018 increased by approximately 4% from the prior year. The following table illustrates the disgorgement and penalties ordered in SEC cases over the past four fiscal years:

As the below table demonstrates, the five percent of cases that involve the largest financial remedies account for the majority of all financial remedies the Commission obtains. Yet the remaining 95% of cases not only constitute the bulk of the Enforcement Division’s overall activity but also address the broadest array of conduct.

The Supreme Court’s 2017 decision in Kokesh v. SEC,18 in which the Court held that Commission claims for disgorgement are subject to a five-year statute of limitations, continues to have a significant effect on the Commission’s efforts to obtain disgorgement. With respect to matters that have already been filed, the Division of Enforcement estimates that the court’s ruling in Kokesh may cause the Commission to forgo up to approximately $900 million in disgorgement, of which a substantial amount likely could have been returned to retail investors.

Individual Accountability

Individual accountability is critical to an effective enforcement program and is one of the core principles of the Division of Enforcement. In FY 2018, 72% of the Commission’s stand-alone actions involved charges against one or more individuals, approximately the same percentage as in FY 2017 (73%). Many of the individuals charged in FY 2018 include senior officers at prominent issuers and other public figures, including the CEOs of Tesla Inc.19 and Theranos Inc,20 the former CEO of Seaworld Entertainment Inc.,21 a U.S. Congressman,22 the former CEOs and CFOs of Walgreens Boots Alliance Inc.23 and Rio Tinto p.l.c.,24 and a professional football player.

The Division also has sought to penalize individuals and require them to pay back illegal gains. In FY 2018, the Commission obtained judgments or orders for disgorgement and/or penalties from over 500 individuals, representing an increase of 9% over FY 2017.

Relief Obtained

In every enforcement action, the Division seeks appropriately tailored remedies that further enforcement goals. In addition to disgorgement and penalties, there are a wide array of potential remedies available. In each case, the Division seeks those remedies that will be the most meaningful.

Undertakings

One of the most effective forms of equitable relief in Commission enforcement actions are undertakings, which require a defendant to take affirmative steps—either in conjunction with entry of the order or in the future—in order to come into and remain in compliance with the specific terms of the court’s order. The Commission also has authority to impose similar obligations on respondents in administrative and cease-and-desist proceedings.

While the Division has regularly employed undertakings in its settlement recommendations to the Commission, in FY 2018 it employed this remedial tool in novel ways in two significant matters.

•First, the Commission charged Theranos, Inc., a private company, and its founder and CEO with raising more than $700 million from investors in an elaborate, years-long scheme involving exaggerated claims about the company’s technology, business, and financial performance.26 One of the most important elements of the Commission’s settlement with the CEO were undertakings that (1) required her to relinquish her voting control over Theranos by converting her supermajority shares to common shares, and (2) guaranteed that in a future sale or other liquidation event, the CEO would not profit from her ownership stake in the company until $750 million had been returned to other Theranos investors.27 The relief embodied in these undertakings addressed a situation where, because of the capital structure of the company, the CEO had nearly complete control of the company. The undertakings were designed to protect investors from potential misuse of that controlling position going forward.

•The Commission also charged the Chairman and CEO of Tesla, Inc. with securities fraud for tweeting a series of false and misleading statements about his plan to take Tesla private.28 The Commission also charged Tesla with failing to maintain disclosure controls and procedures with respect to the CEO’s communications.29 To settle the SEC actions, the CEO and Tesla agreed not only to pay significant penalties, but also to a set of comprehensive undertakings that require, among other things, (1) the CEO to resign as Chairman and be replaced by an independent Chairman, (2) Tesla to add two independent directors to its board, (3) Tesla to establish a committee of independent directors and adopt mandatory controls and procedures to oversee the CEO’s public communications about the company, and (4) Tesla to employ within its legal department an experienced securities counsel to advise on disclosure issues. 30 These undertakings addressed specific risks—in this case, the potential harm to investors caused by the CEO’s communication practices and a lack of sufficient oversight and control of those communications.

Bars and Suspensions

Imposed One of the most important things that the Commission can do to protect investors is to remove bad actors from positions where they can engage in future wrongdoing. Bars and suspensions are the means by which the Commission prevents wrongdoers from serving as officers or directors of public companies, dealing in penny stocks, associating with registered entities such as broker-dealers and investment advisers, or appearing or practicing before the Commission as accountants or attorneys.

Enforcement actions resulted in nearly 550 bars and suspensions of wrongdoers in FY 2018.

Trading Suspensions

Under the federal securities laws, the Commission may suspend trading in a stock for 10 days and generally prohibit a broker-dealer from soliciting investors to buy or sell the stock again until certain reporting requirements are met. In FY 2018, the Commission suspended trading in the securities of 280 issuers in order to combat potential market manipulation and microcap fraud threats to investors.

Court-Ordered Asset Freezes

Court-ordered prejudgment relief in the form of asset freezes is important to the Commission’s ability to protect investors. These freezes prevent alleged wrongdoers from dissipating assets that could otherwise be marshaled for distribution to harmed investors. Wrongdoers often are adept at hiding and moving assets offshore, and the Commission’s ability to obtain meaningful financial remedies, and to return money to harmed investors, therefore may depend on the ability to obtain an asset freeze at an early stage. These circumstances require seeking federal court action on an emergency basis. In FY 2018, the Commission obtained 26 court-ordered asset freezes.

Litigation

In FY 2018, the Commission obtained favorable verdicts in three trials against four defendants and an unfavorable verdict in one trial against one defendant. As of the close of the fiscal year, the Commission was awaiting a verdict in one completed bench trial. The number of district court trials conducted in FY 2018 (5) is similar to the number of such trials in FY 2017 (4).

In FY 2017, there were various pending constitutional challenges to the Commission’s administrative proceedings (AP) and the appointment of its administrative law judges (ALJ). In June 2018, the Supreme Court held in Lucia v. SEC31 that the appointment of the SEC’s ALJs violated the U.S. Constitution’s Appointments Clause, requiring a new hearing in front of a different fact finder. After Lucia, the Commission stayed all pending APs. The Commission lifted the stay on August 22, 2018, and approximately 200 APs were reassigned at that time. Addressing these APs will require substantial litigation resources during FY 2019.

Allocation of Resources

The Commission has operated under an agency-wide hiring freeze since late 2016. Consequently, the Division’s employee and contractor staffing levels have decreased since the freeze was imposed. The combined number of positions in the Division and the number of contractors supporting our investigation and litigation efforts fell by approximately 10% between FY 2016 and FY 2018. Despite this loss, as the below chart indicates, the Division continued to exhibit significant enforcement-related activity.

While this achievement is a testament to the hardworking women and men of the Division, with more resources the SEC could focus more on individual accountability, as individuals are more likely to litigate and the ensuing litigation is resource intensive. Moreover, additional resources would support two key priorities of the Division: protecting retail investors and combating cyber-related threats.

Noteworthy Enforcement Actions

While the Division’s efforts resulted in many noteworthy enforcement actions in FY 2018, the matters described below give a sense of some of the actions the Commission brought in areas of the Division’s greatest focus, as well as actions in other areas to demonstrate the breadth of the landscape the Division covers.

In FY 2018, the Commission brought charges against:

Direct Impact on Retail Investors and Conduct of Registrants

•Three individuals who allegedly orchestrated a Ponzi-like scheme that raised more than $345 million from over 230 investors across the U.S.

•A group of unregistered funds and their owner who allegedly defrauded thousands of retail investors, many of them seniors, in a $1.2 billion Ponzi scheme,33 and five individuals and four companies for allegedly unlawfully selling securities related to the alleged scheme.

•Five individuals and three companies allegedly behind a $102 million Ponzi scheme that defrauded investors throughout the U.S.

•A company and its principal who allegedly defrauded at least 150 investors in an $85 million Ponzi scheme.

•Ameriprise Financial Services Inc. for recommending and selling higher-fee mutual fund shares to retail retirement account customers and for failing to provide sales charge waivers,37 and for failing to safeguard retail investor assets from theft by its representatives.

•Wells Fargo Advisors LLC for misconduct in the sale of financial products known as market-linked investments to retail investors.

•The pastor of one of the largest churches in the country and a self-described financial planner who allegedly defrauded elderly investors by selling them interests in worthless, preRevolutionary Chinese bonds.

•William Z. (Billy) McFarland, two companies he founded, a former senior executive, and a former contractor, who agreed to settle charges arising out of an extensive, multi-year offering fraud that raised at least $27.4 million from over 100 investors.41

Cyber-Related Misconduct

•The entity is formerly known as Yahoo! Inc. for misleading investors by failing to disclose one of the world’s largest data breaches in which hackers stole personal data relating to hundreds of millions of user accounts.

•The co-founders of a purported financial services start-up with allegedly orchestrating a fraudulent ICO that raised more than $32 million from thousands of investors.

•Titanium Blockchain Infrastructure Services Inc. and its president, a self-described “blockchain evangelist,” for an alleged ICO fraud that raised as much as $21 million from investors in and outside the U.S.

•A broker-dealer and investment adviser for failures in cybersecurity policies and procedures surrounding a cyber intrusion that compromised the personal information of thousands of customers.

•An individual involved in an alleged scheme to manipulate the price of Fitbit securities through false regulatory filings.

•A recidivist securities law violator and his company who allegedly raised up to $15 million from thousands of investors in an ICO by falsely promising a 13-fold profit in less than a month.

•A company selling digital tokens to investors to raise capital for its blockchain-based food review service, which halted its ICO after being contacted by the Division of Enforcement and agreed to an order in which the Commission found that its conduct constituted unregistered securities offers and sales.

•AriseBank and its co-founders for allegedly selling a fraudulent ICO that targeted retail investors to fund what it claimed to be the world’s first “decentralized bank.”

•A former bitcoin-denominated platform and its operator with allegedly operating an unregistered securities exchange and defrauding users of that exchange, and the operator of the exchange with allegedly making false and misleading statements in connection with an unregistered offering of securities.

•Longfin Corp., its CEO, and three other affiliated individuals for allegedly illegal distributions and sales of restricted shares of Longfin Corp.

•Two men who allegedly profited from illegal sales of stock of a company claiming to have a blockchain-related business.

•The founder of a company who perpetrated a fraudulent ICO to fund oil exploration and drilling in California.

•A hedge fund manager for violating the investment company registration provisions based on its investments in digital assets.

•TokenLot LLC, a self-described “ICO Superstore,” and its owners for acting as unregistered broker-dealers.

•An international securities dealer and its Austria-based CEO for allegedly violating the federal securities laws in connection with security-based swaps funded with bitcoins.

Insider Trading

•56 individuals who allegedly misappropriated or traded unlawfully on material, nonpublic information including:

» A corporate board member and U.S. Congressman, Christopher Collins, whose alleged tip allowed his son and his son’s tippees to avoid losses by trading in advance of news of negative clinical trial results.

» An investment banker who allegedly tipped professional football player Mychael Kendricks to trade in advance of four corporate acquisitions being advised by the investment banker’s employer.

» A former chief information officer of a U.S. business unit of Equifax Inc. and a former manager, both of whom allegedly traded in advance of the company’s September 2017 announcement of a massive data breach that exposed Social Security numbers and other personal information of approximately 148 million U.S. customers.

» A credit rating analyst who allegedly misused his access to information about an impending acquisition to tip two friends who traded ahead of the deal announcement.

» An investment banker who allegedly misused his access to the bank’s confidential information to trade in advance of 12 market-moving announcements involving clients of the bank.

» A corporate executive who allegedly profited from trading in advance of three disappointing earnings announcements by the Silicon Valley company that employed him.

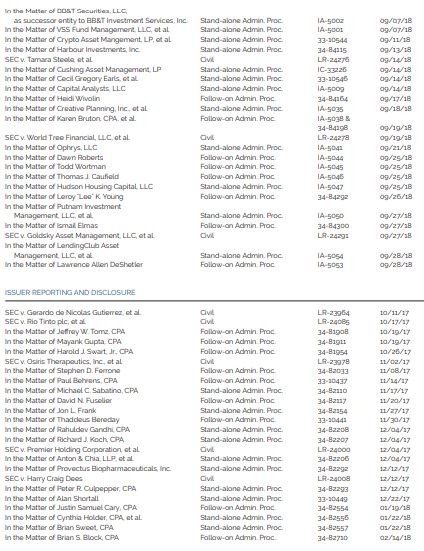

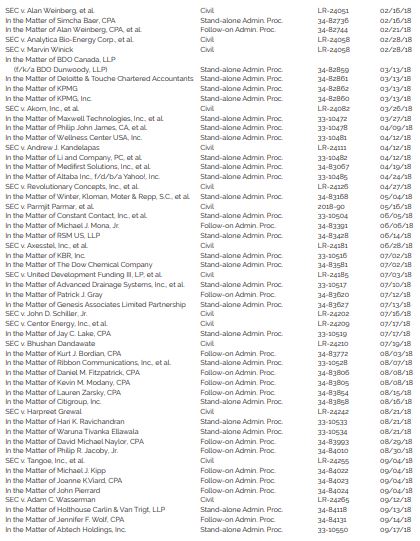

Issuer Reporting and Disclosure Issues and Auditor Misconduct

•54 entities and 94 individuals in stand-alone actions relating to issuer financial reporting and disclosures in the following categories: revenue and expense recognition problems; faulty valuation and impairment decisions; missing or insufficient disclosures; misappropriation through accounting misrepresentations; inadequate internal controls; and misconduct by financial reporting gatekeepers, including:

» Elon Musk, the Chairman and CEO of Tesla Inc., for tweeting a series of false and misleading statements about his plan to take Tesla private.

» Tesla Inc. for failing to maintain disclosure controls and procedures with respect to Musk’s communications.

» Theranos Inc., its founder, and CEO Elizabeth Holmes, and its former President Ramesh “Sunny” Balwani with allegedly raising more than $700 million from investors through an elaborate, years-long fraud in which they exaggerated or made false statements about the company’s technology, business, and financial performance.

» Brazilian oil-and-gas company Petróleo Brasileiro S.A. for misleading U.S. investors by failing to disclose massive bribery and bid-rigging scheme at the company.

» Mining company Rio Tinto and two former top executives for allegedly inflating the value of coal assets acquired for $3.7 billion and sold a few years later for $50 million.

» Walgreens Boots Alliance Inc., former CEO Gregory Wasson, and former CFO Wade Miquelon with misleading investors about the increased risk that the company would miss a key financial goal announced when Walgreen Co. entered into a merger with Alliance Boots GmbH in 2012.

» Six certified public accountants—including former staffers at the Public Company Accounting Oversight Board (PCAOB) and former senior officials at KPMG LLP—arising from their alleged participation in a scheme to misappropriate and use confidential information relating to the PCAOB’s planned inspections of KPMG.

» SeaWorld Entertainment Inc., its former CEO, and its former vice president of communications for misleading investors about the impact the documentary film Blackfish had on the company’s reputation and business.

» A biopharmaceutical company, its CEO, and its former CFO for misleading investors about the company’s developmental lung cancer drug.

» Five public companies for failing to provide financial statements that were reviewed by their independent external auditor when they fled quarterly reports with the Commission on Form 10-Q

Other Noteworthy Actions

•Four Transamerica entities for misconduct involving faulty investment models.

•Merrill Lynch, Pierce, Fenner & Smith for misleading customers about how it handled orders purportedly routed to a dark pool.

•Panasonic Corp. for accounting fraud violations and violations of the Foreign Corrupt Practices Act (FCPA).

•Moody’s Investors Service Inc. for internal control failures and failing to clearly define and consistently apply credit rating symbols.

•Legg Mason Inc. for violating the FCPA in a scheme to bribe Libyan government officials.

•Two firms and 18 individuals in an alleged scheme to improperly divert new issue municipal bonds to broker-dealers at the expense of retail investors, and a municipal underwriter for accepting kickbacks in the scheme.

•Two investment adviser subsidiaries of Voya Holdings Inc. with failing to disclose conflicts of interest and making misleading disclosures in connection with their practice of recalling securities on loan so their affiliates could receive tax benefits.

•13 registered investment advisers who repeatedly failed to provide required information that the agency uses to monitor risk.

•Two U.S.-based subsidiaries of Deutsche Bank AG for improper handling of “pre-released” American Depositary Receipts (ADRs).

•The New York Stock Exchange and two affiliated exchanges with regulatory failures in connection with multiple episodes, including several disruptive market events.

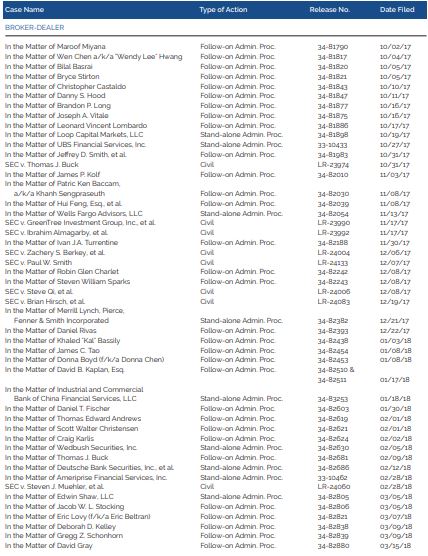

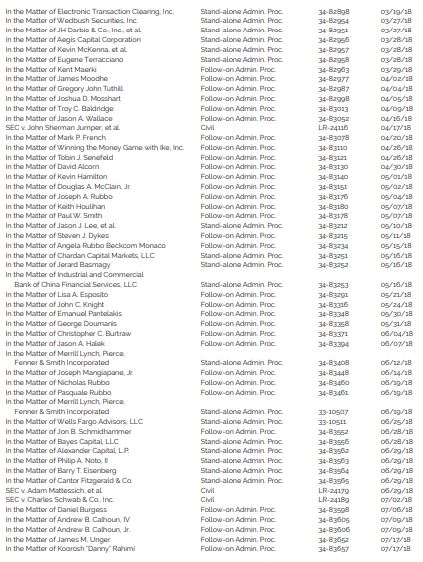

Appendix